Being someone that had a brush with CKD, I would blame our diet and more generally our philosophy around food. I wasn't told that it's abnormal to finish every drop of soup/broth (I paid for it afterall??!) in a soupy meal (think ramen, Maggie sup, curry laksa, etc) until upon reflection during treatment. The killer in CKD isn't the sodium (though it certainly doesn't help) but the purines. The tastier and more umami the broth has, the more purine it has. Purines lead to elevated uric acid, which strains the kidney.

Uric acid is also one of those blood test indicators that don't get enough (or any, for that matter) attention. Rummaging thru my old records, I found out that my uric acid exceeded the high point basically since the first blood test I did in living memory (which is about secondary school time). And no doctor ever gave attention to it. Hari hari cholesterol saja nak sembang.

FWIW, I'm a skinny bugger, which makes it even more dangerous because nobody is warning us skinny buggers to "eat less" or "watch what I eat". And I do eat a lot and I eat everything.

Try reheating on low power for longer duration, like 10mins or more.

I'm more shocked to learn that MV has opened for 25 years already... Now I feel old...

Kubuntu on my main while I set up my Proxmox VE home lab. Plasma is superbly customisable, but there's something about Gnome that's so pleasing to the eyes that makes me look up ways to make Gnome work for me.

I have decided that xRDP is how I want to access my VMs (the only protocol that I'm able to reliably get multi display to work without additional configurations), so that's my bare minimum requirement for now. The test Debian VM I had straight up would not install the xRDP Easy Install script.

Switched to Linux (on my spare laptop) because that's what the programming tutorial I was following at that time recommended (though I've had experience with Ubuntu on and off before this). Such a delightful experience setting up programming stuff on Linux compared to Windows (I know WSL exists, but I like to keep my environments separate). Now my Linux spare laptop is my main PC, while I've barely turned on my "main" Windows laptop lately. Helps that my entertainment is mainly YouTube and not much gaming, though I played a few steam games on it before with a few quirks.

Big news in sports today: Shohei Ohtani goes to the Dodgers!!!

Yep, the currently available PRS funds are in general not great investments for the price you pay (in TER), by virtue of them being mostly Malaysia-centric stock pickings. They are basically Malaysia-themed mutual funds. I've not studied every PRS fund, but most of them do not beat their declared benchmark (most benchmark to FTSE-Bursa Emas Index), or they put a very low bar for themselves (an index comprising a combination of 12-month FD board rate and KLSE) despite being an equities fund.

I've been max-ing out my PRS allocation for the past 3 years. The moment the tax relief for this ends in 2025, I will not be putting a single sen in it anymore.

On Versa PRS, I'm more concerned about the longevity of the platform. At the end of the day Versa is owned by Affin Hwang Asset Management (AHAM), so if Versa does not survive the robo-advisor war and is forced to close down, you most likely only need to relearn where to access it (most likely through AHAM's present own fund investing portal).

The typical place ppl do their PRS shenanigans is on FundSuperMart (FSM).

You're chasing for Versa's 12% p.a. promotion on Versa Save? It's basically RM100 for your troubles (12% for December on RM10,000). RM100 is 3.33% of the RM3000 PRS allocation, or 2 years' worth of management fee. Better than nothing lah I guess.

https://www.ppa.my/prs-funds-information/

There's no best. The ones with lowest management fees often have a sales charge. So you gotta evaluate whether you want to pay the fees up front, or let them chip away per year.

Take for example

AHAM PRS Growth -> No sales charge. 1.8% p.a TER.

AMPrs Growth D -> 3% sales charge. 1.5% p.a TER.

The 0.3% TER difference will take 10 years to equalise. At face value, it's better in the long run to pay the sales charge straightaway. However if one were to consider inflation of 3% per year, that initial 3% sales charge will be equivalent to 5.4% after 20 years (assuming the 3% sales charge you put into a 3% p.a FD, while the rest is invested at 0% growth).

The 'growth' style funds also tend to have higher TER, possibly due to the way they generate the "growth"-like performance by frequent trading.

Long story short: tax relief is not free, it's being paid in the form of the TER and underperformance of the PRS fund you subscribe. Pick one and don't look back.

A bit of fun with numbers: extrapolating this performance with the last dividend of 5.35%, this translates to dividend of 7% in 2024, before management fees.

Having just finished the latest Kluar Sekejap episode with Tun M, I must say, that guy sucks.

Someone probably feels the same about a hobby you're obsessed about. Just the nature of hobbies.

They aren't doing this for the school students.

"Ceased operations" was a demonstration how little journalists/reporters know about the subject they are reporting on. In the world of chemical factories, "shutdown" does not mean "cease operations".

PASPay Technology has since updated the app’s website with a pop-up notice which said that users can obtain MyOnePAS from both Google Play Store and Apple App Store by the end of November 2023.

lol I've been observing how the various news outlets report this item. Almost all of them demonstrated that they do not understand what's going on. A "shutdown" is basically when a plant stops operations to perform periodic maintenance or upgrading works. Using the word "temporary" is just a cover-ass phrase to say "I think they are going to end businesses (because that's what I think that word means, and also that will bring in the clicks), but their press release says it's not long term...? Let's be safe and cover both cases." Shutdowns are by its very own nature, temporary. It's like saying "permanent death". Inb4 "transitory inflation".

Paling funny is one headline that reads along the lines of "Lynas shuts all operations in Malaysia...". I kek.

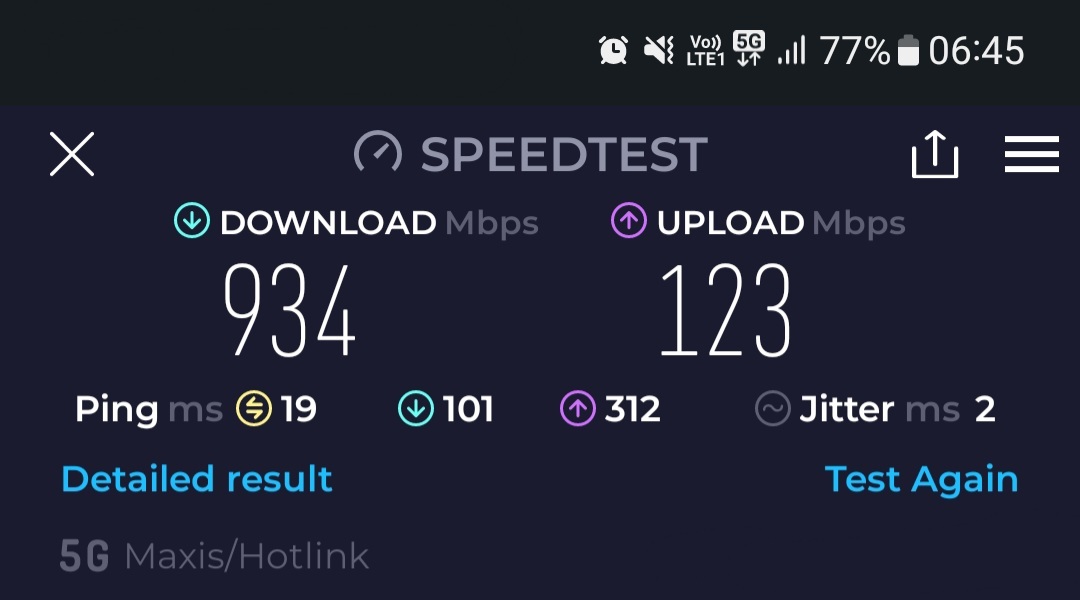

Yesterday kutuk why 5G, today stimmix with Hotlink 5G. Though annoyingly it keeps switching between 4G and 5G when I'm sitting still, and office smack on the center of KL.

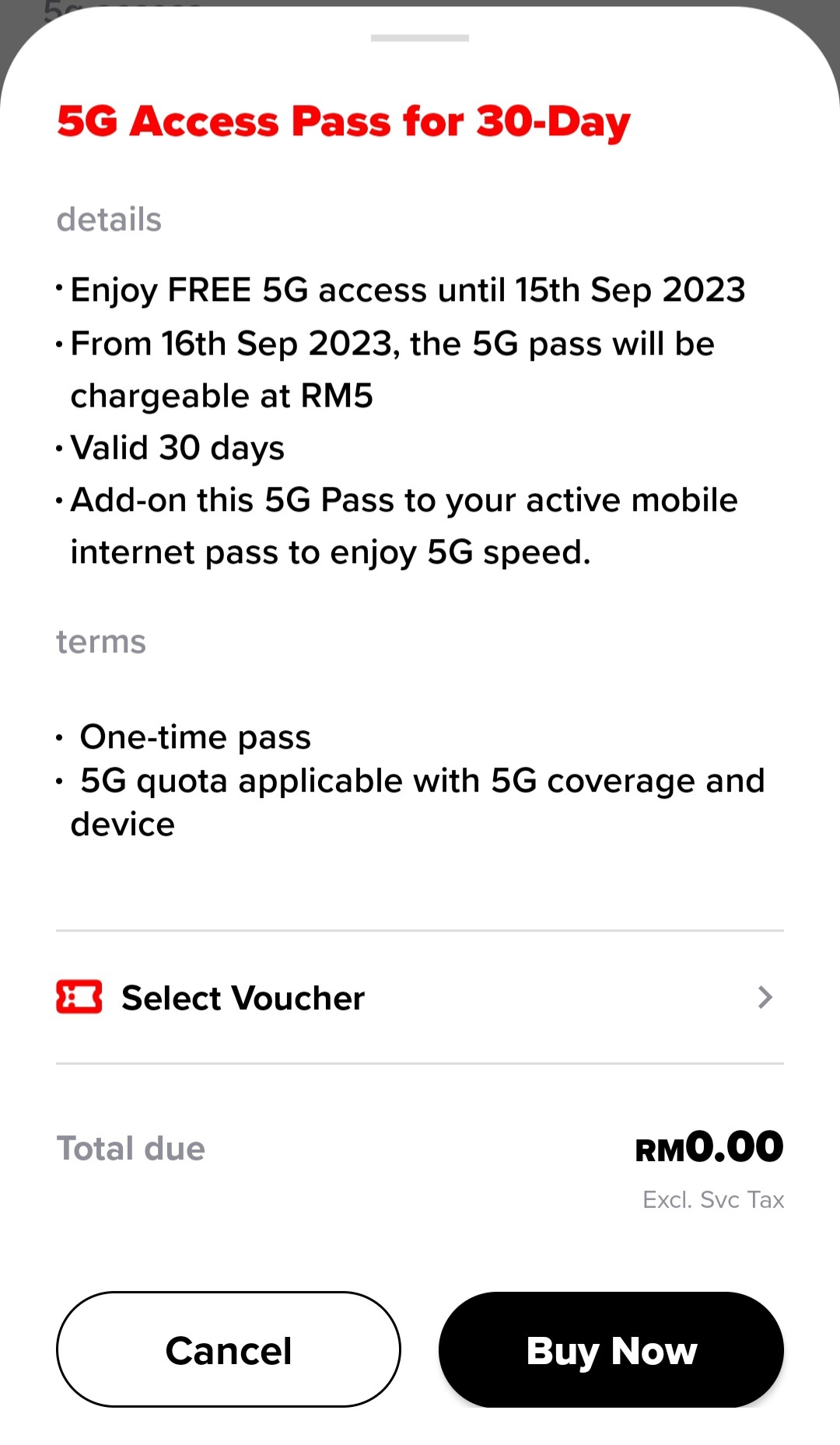

Hotlink/Maxis finally has 5G, but at RM5 per month. Whatever happened to 5G being cheaper than 4G or whatever propaganda it was before this? If cheaper, why need extra pass just to access the network...?

More like sushi-shaped Malaysian treats.

*RM1 service fee applies per investment transaction.

Still working my way towards a job/career that can grant me the mobility to leave this country.

Bought the following two voter promo items, with findings:

-

Dominoes buy one regular, buy 1 large at RM1. Caveat was need to buy regular pizza at ala carte price, which is RM35.90. Total is RM36.90. The other issue? 3 hour lead time. Order at 6pm, 9pm baru dapat lol.

-

Tealive RM6 for selected drinks. No caveat. In fact got loophole. Buy using the app (I used TnG, and pickup), pick large, and can buy multiple. Regretted coz I bought regular, and only thought to check after the fact lol.

Didn't bothered to vote actually today. but gf keep annoying me about it. so first time go voting noon time. Literally no queue. would recommend next time go vote at noon time also instead of long queue in the morning.

Cash flow and Net Worth Calculation sheet by BFM x AIA

BFM is running a special 4-part biweekly series during their Evening Edition segment of Inside Story called Fix Your Finances.

The 28th June edition is titled Balancing your Budget Sheet. They provided a useful cash flow and net worth calculator sheet in Excel format, downloadable in the OP link (also found on BFM's Instagram profile page).

The special series' website is www.bfm.my/fixyourfinances

Interesting to note that according to this template, EPF account 1 & 2 are both considered to be part of one's net worth. This is a debatable line item as some people prefer for EPF to be a "forget about it" asset until nearer to retirement.

BNM maintains OPR at 3.0%.

BNM maintains OPR at 3.0%. Especially notable as this is the first OPR decision with a new BNM Governor.