Search

Guidelines for posting

In the absence of a flair system on lemmy yet, let's try to make it easier to scan through posts by type in here by using tags:

- [meta] for discussions/suggestions about this community itself

- [article] for news articles

- [blog] for any blog-style content

- [video] for video resources

- [academic] for academic studies and sources

- [discussion] for text post questions, rants, and/or discussions

- [meme] for memes

- [image] for any non-meme images

- [misc] for anything that doesn't fall cleanly into any of the other categories

Additionally, it is preferred (although not mandatory) to post a brief submission statement in the body of link posts. This is just to give a brief summary and/or description of why you think it's relevant here. Hopefully this will encourage more discussion in this community.

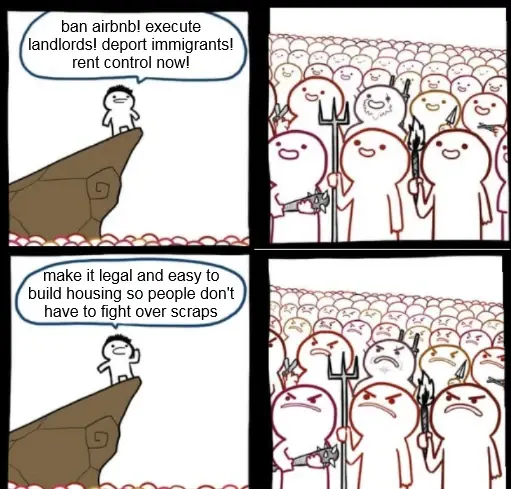

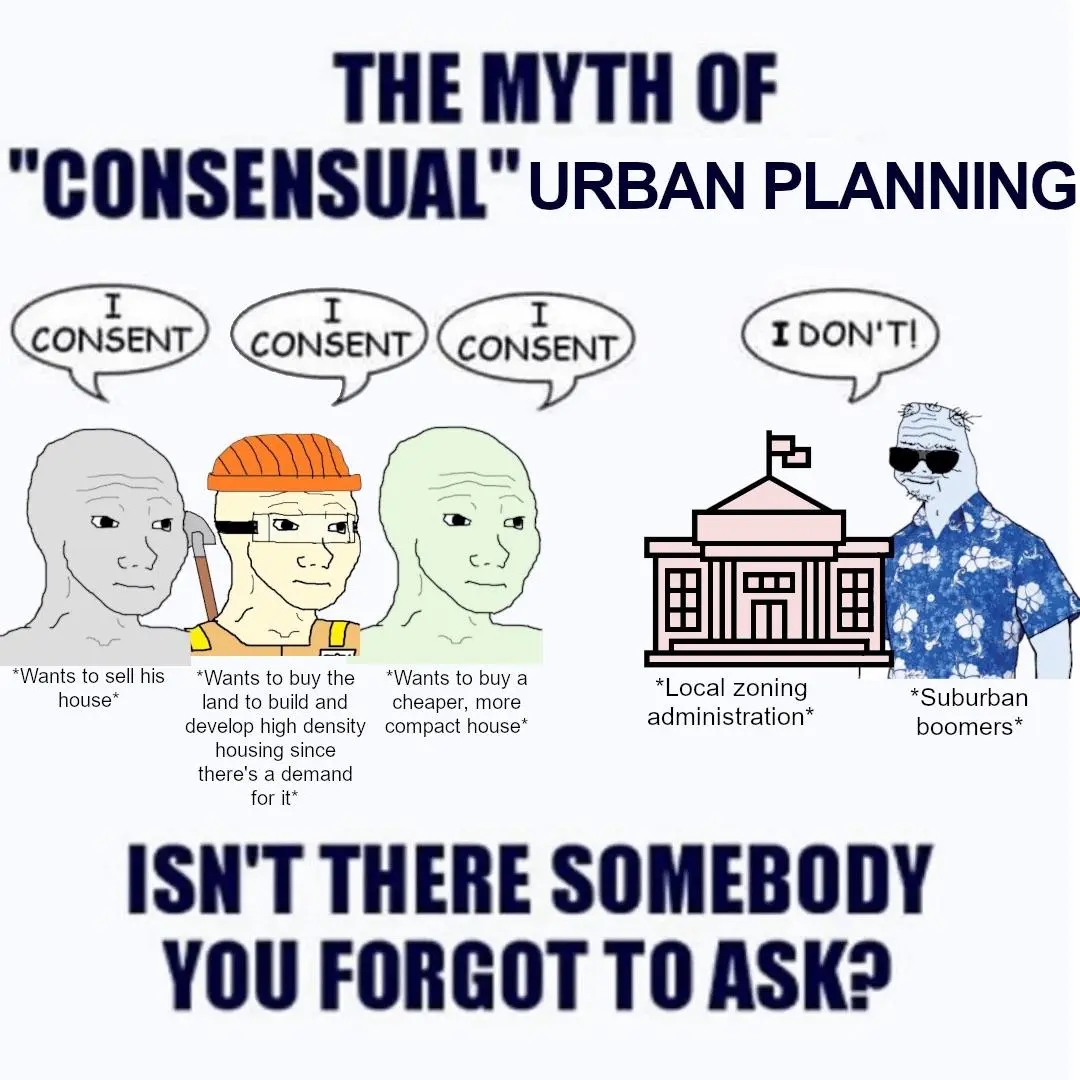

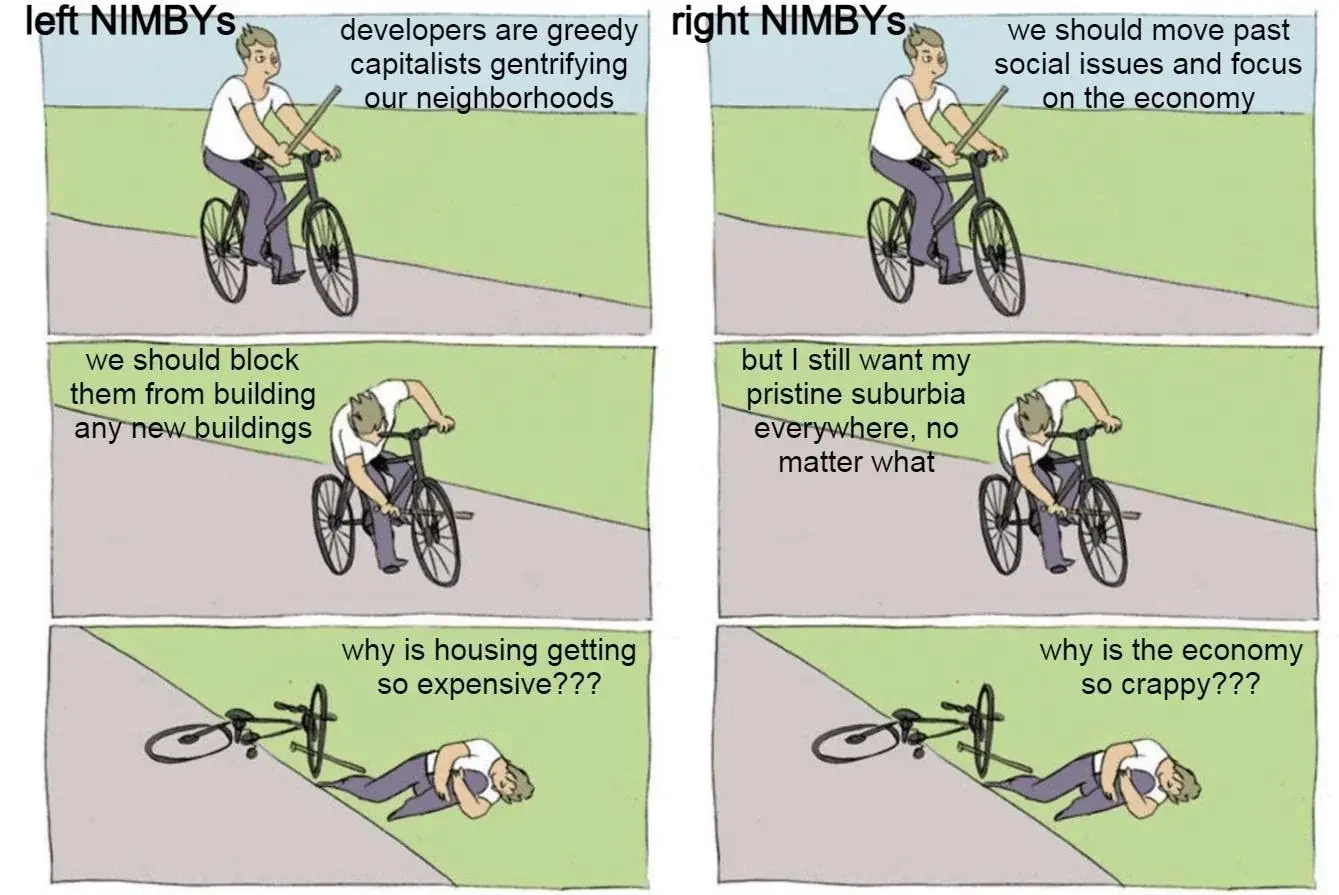

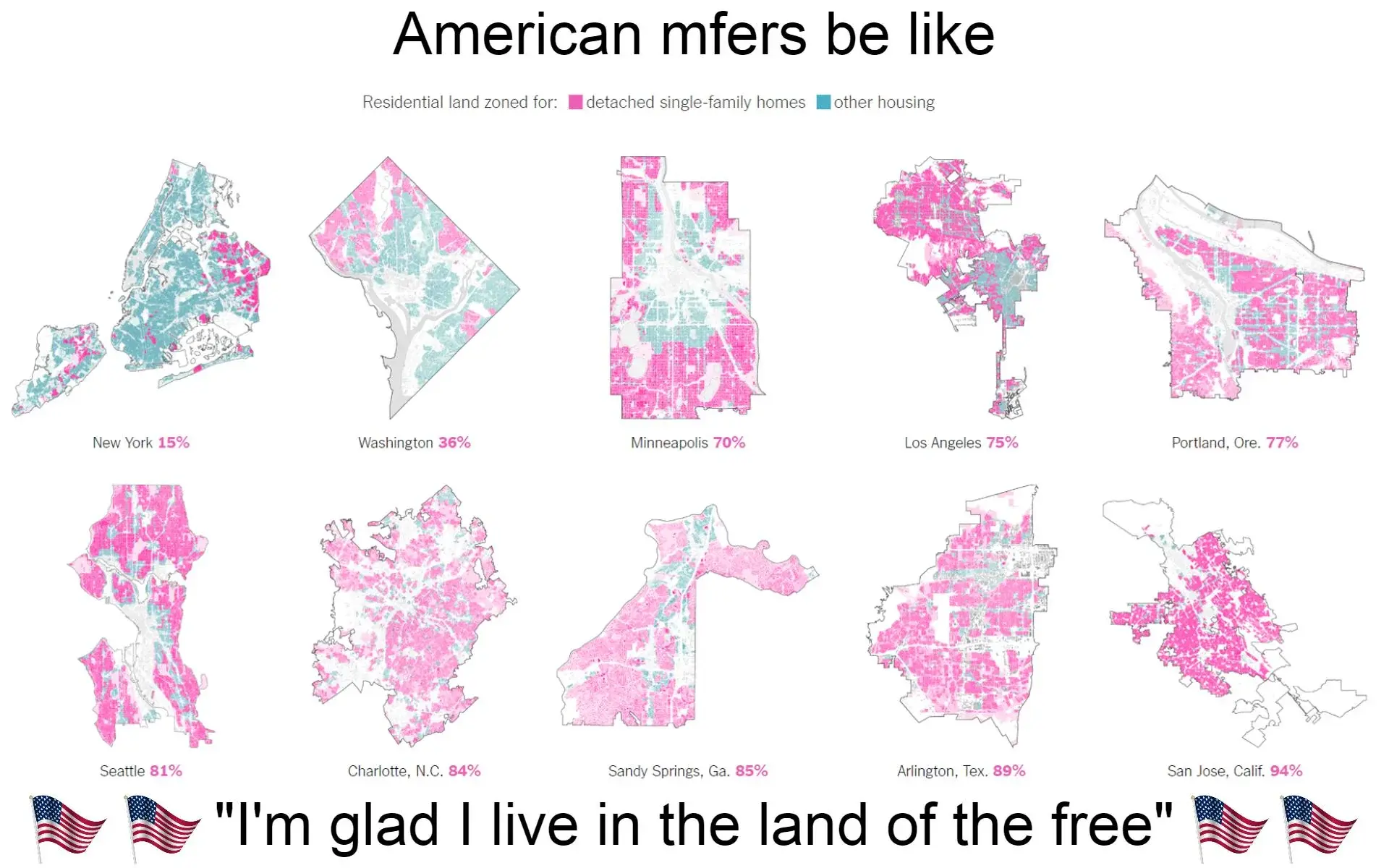

And people wonder why there's a housing crisis

https://www.datalabto.ca/a-visual-guide-to-detached-houses-in-5-canadian-cities/ https://www.nytimes.com/interactive/2019/06/18/upshot/cities-across-america-question-single-family-zoning.html

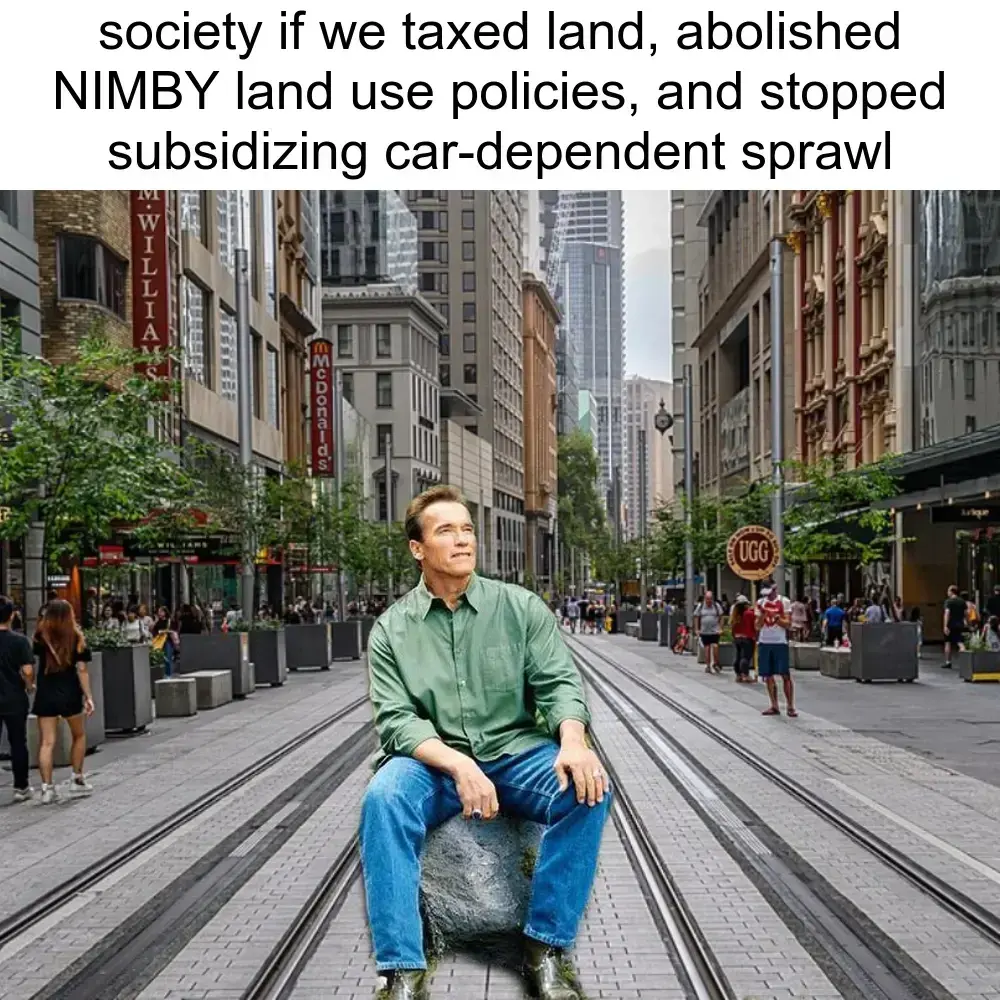

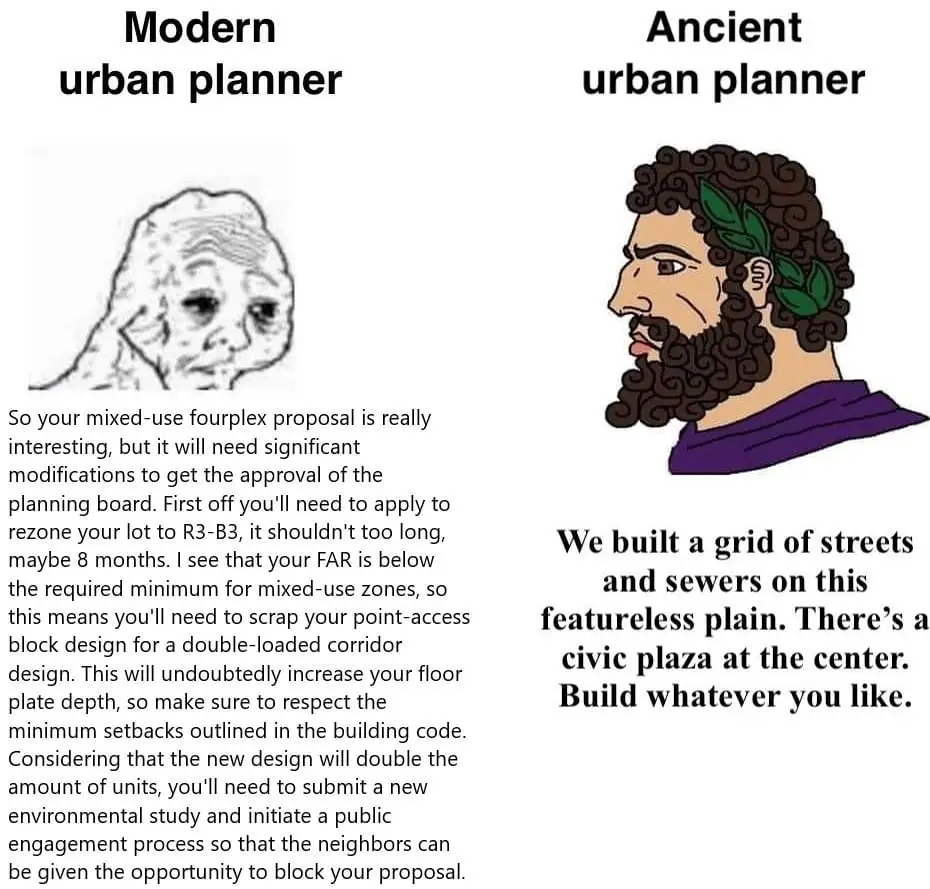

Unfortunately anti-freedom zoning is not limited to the US

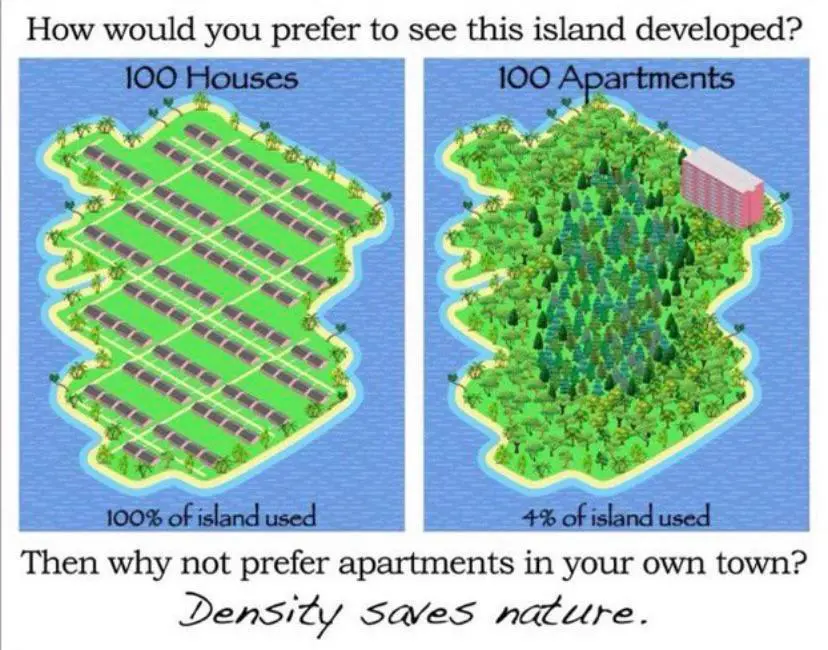

The maps show where it's literally illegal to build anything denser than a detached single-family house. The maps are a little outdated, as Minneapolis famously abolished detached single-family zoning a couple years back. However, it's still only legal to build up to triplexes on most of the land still there. Nonetheless, this has proven enough to stop rents from rising.

NIMBYs HATE them! Fix the housing crisis with these two WEIRD tricks!

As it stands, it is literally illegal to build enough housing on the vast majority of urban land in this country. (And in the US, too.)

Any new housing, even market-rate housing, reduces prices:

> New buildings decrease rents in nearby units by about 6% relative to units slightly farther away or near sites developed later, and they increase in-migration from low-income areas. We show that new buildings absorb many high-income households and increase the local housing stock substantially.

And eliminating onerous zoning and development restrictions can do a lot to stabilize and reduce prices:

> But in four jurisdictions—Minneapolis; New Rochelle, New York; Portland, Oregon; and Tysons, Virginia—new zoning rules to allow more housing have helped curtail rent growth, saving tenants thousands of dollars annually.

> ...

> In all four places studied, the vast majority of new housing has been market rate, meaning rents are based on factors such as demand and prevailing construction and operating costs.

Further, housing supply constraints have had a deep debilitating effect on the economy:

> In a follow-up paper, based on surveying 220 metropolitan areas, they revised the figure upwards – claiming that housing constraints lowered aggregate US growth by more than 50 per cent between 1964 and 2009. In other words, they estimate that the US economy would have been 74 per cent larger in 2009, if enough housing had been built in the right places.

> How does that damage happen? It’s simple. The parts of the country with the highest productivity, like New York and San Francisco, also had stringent restrictions on building more homes. That limited the number of homes and workers who could move to the best job opportunities; it limited their output and the growth of the companies who would have employed them. Plus, the same restrictions meant that it was more expensive to run an office or open a factory, because the land and buildings cost more.

> ...

> There is, in other words, a prima facie case that the housing crisis has caused more damage to [the UK's] GDP than any single event since the Black Death – when two-fifths of the population died.

In addition to abolishing our over-the-top restrictions on development, we should tax land:

> A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements.[1] It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating.

> Land value taxes are generally favored by economists as they do not cause economic inefficiency, and reduce inequality.[2] A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income.[3][4] The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century.[1][5][6]

> ...

> Most taxes distort economic decisions and discourage beneficial economic activity.[14] For example, property taxes discourage construction, maintenance, and repair because taxes increase with improvements. LVT is not based on how land is used. Because the supply of land is essentially fixed, land rents depend on what tenants are prepared to pay, rather than on landlord expenses. Thus landlords cannot pass LVT to tenants, who would move or rent smaller spaces before absorbing increased rent.[15]

> ...

> LVT's efficiency has been observed in practice.[18] Fred Foldvary stated that LVT discourages speculative land holding because the tax reflects changes in land value (up and down), encouraging landowners to develop or sell vacant/underused plots in high demand. Foldvary claimed that LVT increases investment in dilapidated inner city areas because improvements don't cause tax increases. This in turn reduces the incentive to build on remote sites and so reduces urban sprawl.[19] For example, Harrisburg, Pennsylvania's LVT has operated since 1975. This policy was credited by mayor Stephen R. Reed with reducing the number of vacant downtown structures from around 4,200 in 1982 to fewer than 500.[20]

> LVT is arguably an ecotax because it discourages the waste of prime locations, which are a finite resource.[21][22][23] Many urban planners claim that LVT is an effective method to promote transit-oriented development.[24][25]

Even a pretty low LVT can still have benefits:

> It reveals that much of the anticipated future tax obligations appear to have been already capitalised into lower land prices. Additionally, the tax transition may have also deterred speculative buyers from the housing market, adding even further to the recent pattern of low and stable property prices in the Territory. Because of the price effect of the land tax, a typical new home buyer in the Territory will save between $1,000 and $2,200 per year on mortgage repayments.

Everything-bagel liberalism in a nutshell

https://www.nytimes.com/2023/04/02/opinion/democrats-liberalism.html

Lukewarm YIMBYism is much more bewildering than outright NIMBYism.