-

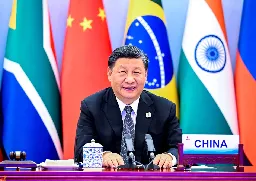

India and Brazil are pushing back against a Chinese bid to rapidly expand the BRICS group of emerging markets to grow its political clout and counter the US, per Bloomberg.

www.bloomberg.com China’s Push to Expand BRICS Membership FaltersIndia and Brazil are pushing back against a Chinese bid to rapidly expand the BRICS group of emerging markets to grow its political clout and counter the US, officials with knowledge of the matter said.

- www.ctvnews.ca BoC expected to raise rates again this week, vying to quash inflation faster

The Bank of Canada is expected to raise interest rates again this week as forecasters say the economy has not softened enough for the central bank to back off.

Deloitte's chief economist, Dawn Desjardins, said there have been some recent signs that the economy is taking a turn, with the latest job report for June showing the unemployment rate rising and wage growth slowing.

But the overall picture suggests inflation is still sticky, wage growth is high and the economy continues to churn, she said.

-

Insolvency firm MNP reports 52% of Canadians are $200 or less away from being unable to pay bills due to rising interest rates and living costs.

www.bnnbloomberg.ca Debt worries up as higher interest rates and rising cost of living take a toll: MNP - BNN BloombergA report by insolvency firm MNP says 52 per cent of Canadians say they are $200 away or less from not being able to pay all of their bills at the end of the month as higher interest rates and a rising cost of living have stretched budgets.

The report says 35 per cent of those asked say they already don't make enough to cover their bills and debt payments, up from 30 per cent in April and a record high for the survey. It also says a record 48 per cent of those surveyed are concerned about their current level of debt.

-

Maximizing the First Home Savings Account: A Complete Guide

Stumbled upon an excellent podcast interview featuring Evan Neufeld, CFP, and Aaron Hector, CFP, R.F.P., TEP.

They delve deep into the topic of FHSA (First-Time Home Buyer Savings Account) and cover all the crucial details you need to know.

From the intricate rules and eligibility criteria to contributions, deductions, and even tax efficiencies, they leave no stone unturned.

They also discuss what happens if you don't buy a home, qualifying withdrawals, and the transfer of funds. Moreover, they provide a comprehensive comparison between FHSA and Home Buyers Plan, as well as insights on how it stacks up against TFSA, RRSP, and RESP.

I highly recommend giving it a listen!

-

Statistics Canada says the unemployment rate rose to 5.4 per cent in June, reaching the highest level in over a year.

www.bnnbloomberg.ca Canada job gains triple expectations, keeping hike on table - BNN BloombergCanada’s labour market bounced back strongly, more than offsetting losses from a month earlier, keeping pressure on the Bank of Canada to raise interest rates again next week.

The country added 60,000 jobs, driven by gains in full-time work, while the unemployment rate rose to 5.4 per cent, the highest since February 2022, Statistics Canada reported Friday in Ottawa. The figures beat expectations for a gain of 20,000 positions, but missed the forecast for a jobless rate of 5.2 per cent, according to the median estimate in a Bloomberg survey.